This is the third in our 4-part Service Company Exporter Series that explores the challenges service companies face when exporting and what tools and support service companies might benefit from. Previously, we looked at the importance of the U.S. economy’s service sector as well as the most common barriers to export faced by manufacturing and service firms.

This blog compares the barriers to export faced by manufacturing and service firms, with the export assistance activities provided by U.S. state export assistance programs. As identified in the previous blog, service companies typically experience more export barriers than manufacturing companies and these export barriers tend to be more complex.

As service firms engage in the exporting process, they often seek the assistance of state and federal export assistance programs to help them navigate the complexities of exporting. Thus, understanding whether state export assistance programs are providing the appropriate export assistance activities to service firms is important for both parties as they seek to bring more U.S. services to international markets.

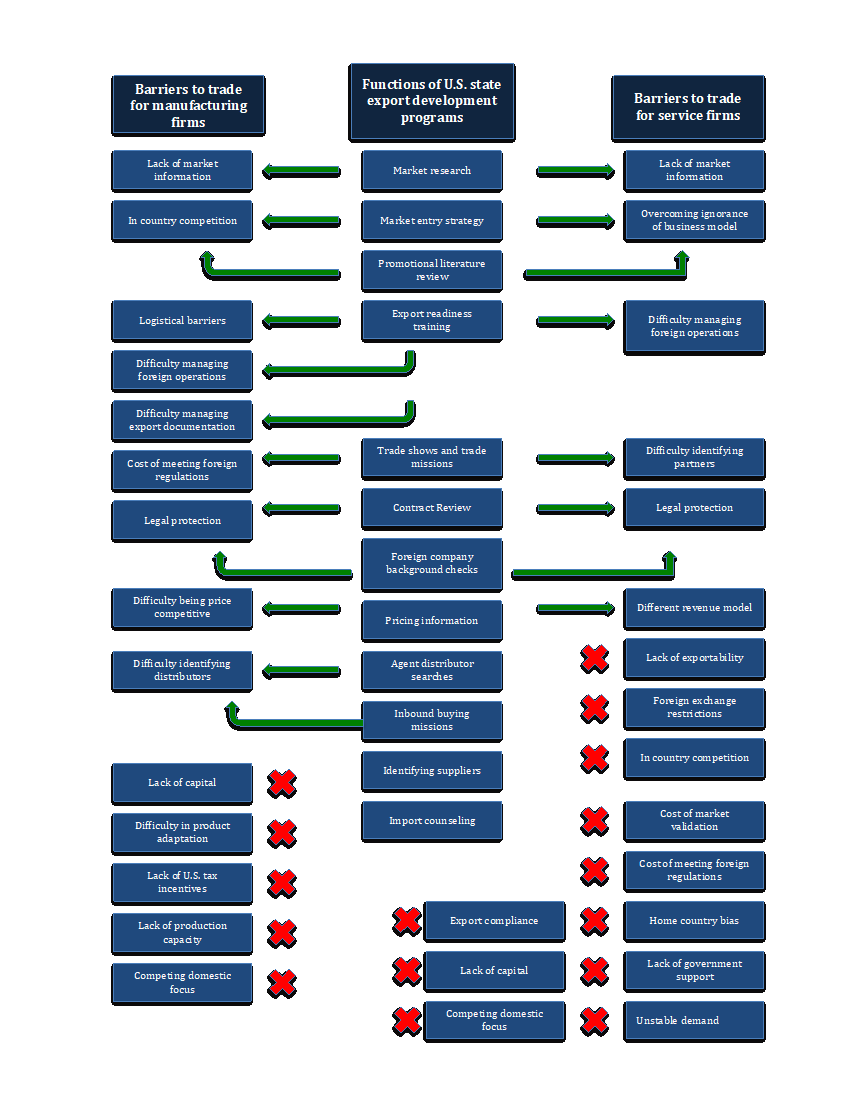

The chart below summarizes the functions of state export assistance programs (middle column) and how they assist manufacturing and service companies with their most common barriers to exporting.

The highlights of the chart above are:

- Of the 12 identified functions of U.S. export development programs, 10 addressed export barriers identified by either manufacturing or service companies, or both.

- The 2 functions of U.S. state export development programs that did not address either an export barrier for a manufacturing firm or service firm were: “identifying suppliers” and “import counseling”.

- For manufacturing companies, two-thirds (9 out of 14) export barriers identified by the companies are addressed by U.S. state export development programs.

- For service companies, one-third (6 out of 17) export barriers identified by the companies are addressed by international trade development programs.

These results show how U.S. state export development programs are skewed towards providing support for manufacturing companies leaving service companies, which make up some 80% of U.S. GDP, with a limited range of export assistance choices.

Our fourth and final blog in our Service Company Exporter Series will put forward some suggestions about how U.S. state export development programs can redress the balance between assistance for manufacturing and service companies.