When you go online today to use one of your Apps, you are one of more than 3.4 billion App-empowered users – that’s 40% of the world’s population. By 2021, that App utilization figure is expected to be >6.3 billion users; some 80% of the projected 7.8 billion world citizens. This means that over the next 3 years, a further 2.9 billion people will be using Apps, implying a doubling of the penetration rate to 85%. The big picture therefore and the message of this blog, is that we are all, the world’s billions of citizens, going to be App users. The details, and the focus of this IBT Online App blog-series, concern geographic location, the rate of uptake, which devices, platform and use.

An important insight is that globally, users are increasingly accessing Apps through their mobile smartphones (today >2.5 billion users) rather than their desktops. Innovative, easy to roll out and cost effective technologies facilitating the mobile 1st world (think China, India and Indonesia…), have enabled these countries to leap-frog the infrastructure dependent PC route, of users in mature Western countries. Let’s take a dive and see where all the App users are in this world and then make a case study of the world’s largest App market, China.

This blog is App Story #2 in a series of 4 blogs all about the Online Global App Story:

- App Story #1 the Apps, the Apps themselves, how many and the market leaders

- App Story #2 the Users, where are they and who are they

- App Story #3 the Hours, what are users doing on all these Apps

- App Story #4 the Money, follow that cash pile

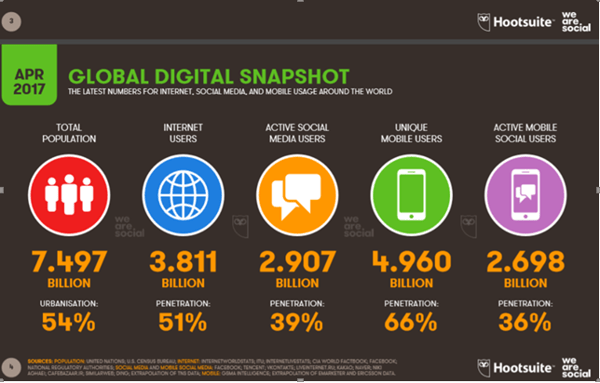

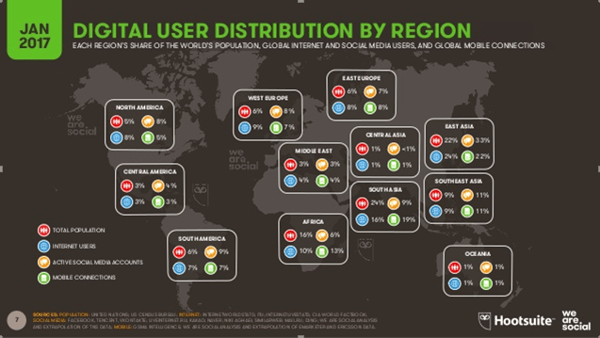

Follow world demographics and you find the App users, led by China (900 million active App users), India (300 million), the United States (226 million), Brazil (80 million), with Japan and Germany (50 million each). These countries alone represent almost 50% of the world’s App users! Globally there are >1 million new App users signing up every day, mainly in the emerging mobile 1st markets and almost all through their increasingly ubiquitous smartphones. Smartphone uptake demands disposable income as well as the infrastructure investment, and there is now clearly a momentum effect of the uptake and hence user growth. Stand out examples of fast growing mobile 1st markets are Indonesia and South Korea with 55 and 36 million users each. See the Global Digital Snapshot and Digital User Distribution by Region diagrams below to see some of the detail available from Hootsuites “We are social” annual 2017 report.

On the smartphone itself, worldwide users have a limited choice: there are 4 leading mobile App platforms: Google (39%market share), Apple (22%), Nokia (15%) and then Samsung (13%), together covering 89% of the market. That is a dominance that will be with us for a while. By contrast, across these platforms, there are many millions of localized Apps available. Each country market has many hundreds of thousands, if not millions of App developers, enabling users worldwide to download some 197 billion Apps in 2017; this compares to 150 billion Apps in 2016 and a projected 353 billion Apps in 2021.

Smart mobile device enablement demands levels of infrastructure investment and disposable income, and provides some interesting surprises. The ComScore Mobile Hierarchy of Needs study revealed that “mobile devices (smartphones and tablets) represent over 60% of digital time in all markets studied, but it was more than 90% in Indonesia. Clearly the extent to which a market can be deemed ‘mobile first’ varies considerably around the globe”. The broad message is that we are all going smart device mobile, but the question is the rate of conversion, as consumers in developed countries migrate from their legacy desk-tops to mobile, whereas consumers in many non-developed countries leap-frog and go mobile-first. Today there are almost 5 billion mobile users globally and 3.4 billion of them are app users! Check out the Digital User Distribution By Regions table below:

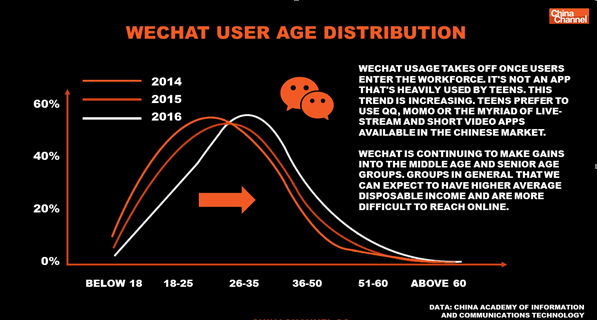

To answer the big question of who are todays App users, let’s look at the worlds #1 App: WeChat, launched in 2011, known in Chinese as Weixin (微信, “micro letter”) in the world's #1 App market - China. Owned by leading Chinese internet value added services provider Tencent, which also controls Chinese internet leaders QQ, Kwai (leading video App, with > 400 million users) and Penguin Intelligence (China internet industry trend research unit), WeChat boasts over 900 million users, >10 million official accounts and >20,000 developers and each number is growing fast.

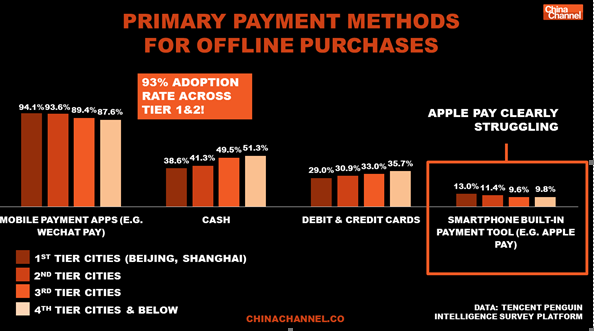

Colloquially known as the “One App to Rule Them All”, WeChat is an App aggregator of extraordinary scope, both as a platform and portal. For people like us, at IBT Online, concerned to know what the future of the App world might look like, WeChat and its users provide insight and guidance. WeChat is a mobile-first App, created for a society not beholden to desktop PCs. From inception, WeChat was focused on building a mobile lifestyle, to address every aspect of its users’ lives, including social, financial and business. Therefore it created its sub-App universe within the WeChat App itself, known as “official accounts” of which there are >10 million and increasing daily.

Then there is the WeChat wallet, a complete integrated payment system, binding and enabling users and official accounts to transact in a secure, controlled and managed environment. It is the WeChat eco-system monetization, that draws users in and keeps them there: the WeChat dominant commercial environment drives growth as users and official accounts sign up. Penguin Intelligence tells us that the majority of WeChat users are workers aged 26-35, urbanites and they are using the App for increasingly commercial functions.

Our next App-series blog will focus on the Hours, what are users doing on all these Apps?

Sources: Wearesocial, Statista, Hootsuite, Newzoo, App Annie, Econsultancy, Google, Apple, comScore, GSMA, Connie Chan