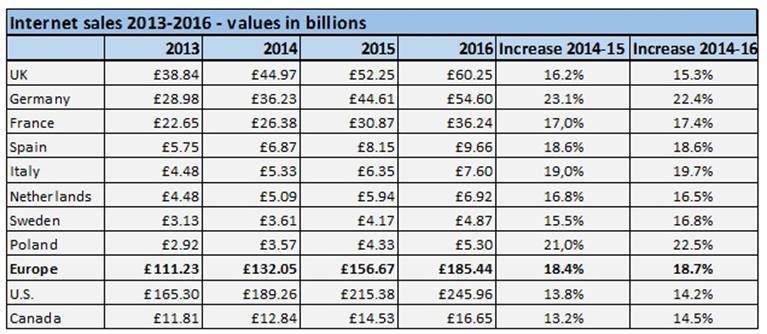

Today, commerce in Europe is all about the e’s; there are 2, but add a 3rd in front and you have it. Everywhere (note 4 e’s) we look for opportunities and growth we find a big bold "e" written. The big EU stories for 2015 will be ecommerce; ecommerce will continue its boom across Europe this year, growing at a very healthy >18%. The figure for 2014 was 18%, 22% in 2013 and 2016 is projected at 19%. FYI, this compares to the US where online sales are expected to grow in 2015 at 14%.

This is an impressive level of growth, despite the fact that we know that 2/3rds of EU eshoppers will not buy in a foreign language - and in case you wondered we have 24 official langauges here in Europe! People, Europeans included, when online, prefer to search, browse web sites, check out goods and services, compare and complete purchases in their native language. I imagine you feel the same way?

This is an impressive level of growth, despite the fact that we know that 2/3rds of EU eshoppers will not buy in a foreign language - and in case you wondered we have 24 official langauges here in Europe! People, Europeans included, when online, prefer to search, browse web sites, check out goods and services, compare and complete purchases in their native language. I imagine you feel the same way?

So let's accept that Europe is not a single market; it is a political and economic union of 28 (and rising) countries. We do not speak the same language, we do not have a single culture, we think of ourselves by nation first (Estonian, Greek, German, Polish and so on for another 24…) and European second, sometimes with difficulty. This determines a successful pan-European ecommerce strategy. There are indeed economies of scales to be had here, we are >505 M people in the EU 28, and > 740 M across the whole of Europe. Europe is the world’s largest ecommerce market. Those 2015 growth figures will extend that lead, but when you exploit ecommerce in Europe, you must do so on a nation by nation basis. You cannot simply roll out the same English language .com site, if you decide to sell across Europe and expect it to be successful.

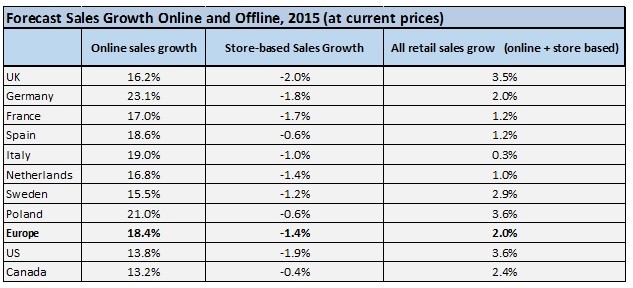

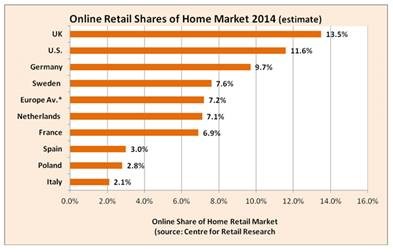

So let’s look at European ecommerce nation by nation. A focus upon the big five markets, where online sales are forecast to grow as follows; Germany leads with 23%, then Italy 19%, Spain at 19%, France with 17% and then the UK at 16% (the largest market, see below). The European recession forced many shoppers online (discounts, bargain prices and time available due to unemployment…) rather than purchasing from traditional high street and mega stores. Do know that in Europe, online retailers are expected to grow 12 times faster than those traditional outlets. You can see the effect in many high streets and some planned, but “on-ice” mega store build projects. Finally, there was also an element of catch-up, for some countries with smaller ecommerce uptake, see table below.

Research also demonstrates the growing use of mobile technology. Purchasing online is increasingly attractive and convenient as online sites become mobile responsive and devices (smartphones and tablets) proliferate. Mobile shopping will move from >8% to >13% of the online retail spend in 2015, that is >€27Bn (>$30Bn). Is your site mobile responsive?

For Europe's largest online market, the UK, growth at 16% means purchases increase by €10Bn ($11Bn), from €60Bn ($66Bn) to €70Bn ($77Bn), see table below. Brits are online all the time! Probably sitting in the pub, drink in one hand and mobile phone in the other; it’s called inspiration. They are the most frequent eshoppers in Europe, expected to make >21 purchases and spending €1575 ($1781) in 2015. A quick recap on Germany with its 82M consumers, the largest nation in Europe. Germans love the internet and ecommerce, with high penetration levels of 83% and 77% respectively. Also, note that >91% of the 30 to 49 age group buy regularly online. Looks great for the future! The sheer size, in terms of consumers and excellent online infrastructure, means that Germany and the UK jostle for 1st and 2nd place, for ecommerce retailers looking for growth.

Amazon in Europe, just being Amazon

When reviewing ecommerce in Europe, Amazon is unavoidable. The company is now everywhere, perhaps not surprising as it is also the Everything Store. It took me a good weekend to read Brad Stone's insightful, meticulously researched book, "The Everything Store", about Amazon and its, shall we say, very forceful and visionary boss, Jeff Bezos. It’s a great read! I learned a lot, all the better to understand the news that comes out of Europe, concerning Amazon's huge success here.

Notable, of course, is Amazon's top line (soaring sales) and carefully controlled bottom line (frugal on costs, notably employment and tax...). Amazon’s EU success here led to the recruitment of >6,000 staff in 2014, that is more than in any year since opening up their first European country specific website way back in 1997. They are building more of their famed super-techy and huge distribution centers in Poland, where labour costs are low at €3.2 ($3.6) per hour, compared to the >9,000 headcount in Germany who are paid €9.9 ($11.2) per hour, where there have been union and strike issues. Then there are the >6,000 order fulfilment staff in the UK who are paid €10.4 ($10.8) per hour. Amazon now has >32,000 staff in 50 locations across Europe to manage its growth. EU revenue in 2014 was >15 times that of 2003.

But, and a big unresolved but, is Amazon's fiscal structure. It uses a Luxembourg company as its EU HQ, directing its operations and managing all its European websites. LuxOpCo, declared €14Bn ($16Bn) of revenue in 2013; this is about 20% of their worldwide sales. Currently the European Commission (EC) whose role it is to ensure an open and level market, is conducting a series of enquiries into LuxOpCo, its EU websites, and Lux SCS, the recipient of royalties. The UK tax authorities, in conjunction with other EU tax authorities, complain of the lack of co-operation and value added tax receipts based on the Bn's of Amazons sales in the country. Let’s just leave this as the EU tax authorities and Amazon's relationship is all work in progress, to be resolved.

EU ecommerce directives, information and events

There is no shortage of ecommerce directives (at a European, as well as national level), information, and events to get you up to speed on this vast and fast evolving ecommerce in Europe subject. I have assembled some of the most useful sources, starting at the very top with the European Commission (EC). The EC issued the Electronic Commerce Directive, which sets up an Internal Market framework for electronic commerce, to provide legal certainty for businesses and consumers alike. It establishes harmonized rules on issues such as transparency and information requirements for online service providers, commercial communications, electronic contracts and limitations of liability of intermediary service providers. : http://ec.europa.eu/internal_market/e-commerce/directive/index_en.htm. Again at a pan-European level there is the European Multi-channel and Online Trade Association (EMOTA). They help European online traders and distance sellers succeed in the European marketplace, try: http://www.emota.eu/

If you want a list of trade shows, exhibitions and seminars across Europe, try this useful link. The web page http://ecommercenews.eu/events-calendar has a listing of > 40 that can keep you busy every month this year, traveling between London, Paris, Malmo, Utrecht, Dusseldorf, Colmar, Zurich, Madrid and Oulo! Get ecommerce ready for 2015!

Get essential facts, figures, inside information and tips to grow your European online sales.