Is India’s online world finally coming of age?

Lured by the potential size of the market, an intrepid US manufacturer we know started exporting to India in early 2012. While it found willing in-market partners, the challenge of complex tax structures, patchy infrastructure, poor logistics and out-dated payment systems, meant that its B2B and B2C sales objectives were far from achieved. Yet this year, fortunes appear to be changing. Our US manufacturer’s targets have doubled and doubled again in 2016. While few doubt the potential of India’s enormous market, the challenges of doing business and, notably, online business, has deterred many exporters.

But might it be time to put India seriously on the online map? Looks likely. One of the key drivers is the number and profile of Indian internet users.

100 million new internet users a year

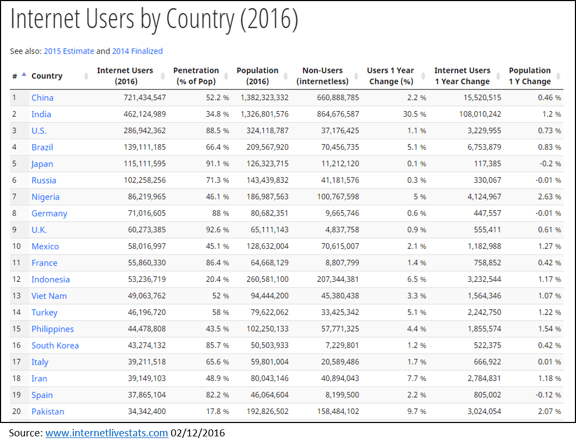

Internet penetration is around 34% in India – far lower than the 65-70% found in China or Brazil or the near 90% in the USA and UK. Yet the combination of India’s 1.3 billion inhabitants, young demographics and changing infrastructure landscape means that it is one of the most important global online markets to watch. The number of internet users in India grew by over 100 million in 2016, meaning that over 462 million people were active internet users.

India is now the second largest internet market in the world after China.

Taking the data from the research organisation Internet Live Stats, India’s online population could be twice the size of the US online population by the end of next year (see table, source: www.internetlivestats.com).

Digital India and help from Tech Giants

India’s infrastructure remains a major hurdle. The hardware is simply lacking: there are not enough fibre optic cables, routers, switches…the fast broadband needed for today’s internet economy is restricted to better income urban areas. The government has launched several big initiatives: Make in India, Innovation Fund, Skill India and most importantly Digital India. The latter has acted as a springboard for global tech giants eager to carve out market share in India: Google launched Project Zoom while MicroSoft has its ‘White Space’ and FaceBook’s drones are hovering to bring the internet to Indian villages.

Localization is key

One of the clearest signs that these efforts are paying off is the number of major internet companies in India now launching multi-lingual Indian websites. English is the lingua franca of the Indian business world and this has been reflected online. In late 2015, however, Quikr, India’s leading online classified ad company, launched new sites in Hindi and six other Indian languages. Snapdeal and Paytm have followed by launching their websites in Hindi as well as other major Indian languages.

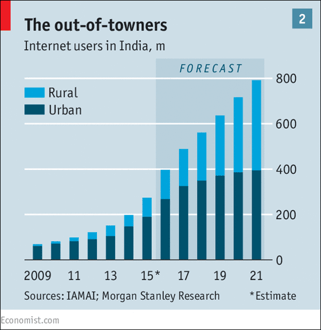

These companies reckon that the next big slice of new internet joiners will be more rural and more at ease in their mother tongue (see graph from The Economist). The Internet and Mobile Association of India (IAMA) reports that the amount of Hindi content increased by 94% in 2015, albeit from a limited starting base (www.iamai.in/research/reports_details/4637).

Baidu snaps at Google’s heels

Searching the web in India is dominated by Google with over 90% market share. But as a tantalizing prelude to a predictable market share war, China’s dominant search engine group Baidu made some bold moves in 2016. Baidu is betting that strong localization with local languages will help it capture the next wave of India’s online population. In early 2016, Baidu launched its Mobomarket app in Bengali, Marathi, Tamil, Urdu and Telugu in addition to the existing Hindi and English versions in India.

The Millennial market

While many of the new internet users in India will come from less urban centres, most will also be young. India is one of the youngest demographics in the world with two-thirds of its population under the age of 35. This is reflected online: the IAMA estimate that 75% of online users are aged 15-34. Intriguingly, India’s young population, while remaining ambitious in English, also appear less willing to forgo their mother tongue when it comes to the digital world. This bodes well for Indian social media websites in local languages which, still small today, are emerging as in-market players to be reckoned with and another sign that the Indian online market is coming of age. And what of our US manufacturer? They have decided not to launch into Hindi quite yet although their Indian website now looks and feels very local, optimized for the strong growth in demand that their budgets are now anticipating.

#indiaonline #exportingisGREAT #UKIndia