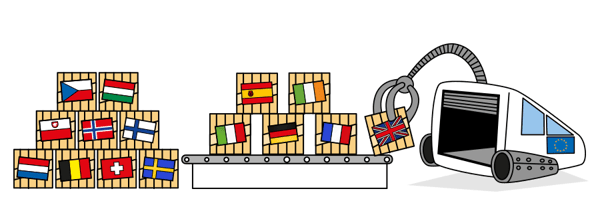

The transatlantic economy is bigger than ever. Big, trillions big and compared to other international economic relations, the biggest by far. US foreign direct investment (FDI) in Europe totals >$13.6 (£8.4) trillion. By return of compliment, European FDI in the USA has reached >$9 (£5.8) trillion. Do the math, and we have >$22 (£14.2) trillion of transatlantic FDI. Need more convincing? The transatlantic economy generates >$5.5 (£3.5) trillion in annual total commercial sales. The detail is to be found in this year’s “Transatlantic Economy 2015 Report” which puts it succinctly: “Despite economic turbulence, the US and Europe remain each other’s most important markets. No other commercial artery in the world is as integrated…” The Transatlantic Economy 2015 Report is an Annual Survey of Jobs, Trade and Investment, conducted by authorities on the subject including John Hopkins University, the American Chamber of Commerce to the European Union (AmCham EU) and the Trans-Atlantic Business Council (TABC). The full version comprises 112 information packed pages, reminding us all (which we do need from time to time) of the pre-eminent importance of the economic relationship between the 62 European countries (28 of which are in the European Union) and the 50 United States. The report is very readably structured into: A Tale of Two Economies, The Post-Crisis Transatlantic Economy, The 50 US States and, the last chapter is entitled, European Countries. These are then followed by the somewhat heavy going statistic packed appendices, of which there are more than 40 pages! If you are looking for US/EU stats, look no further. For the time pressed amongst you, I strongly recommend the Transatlantic Economy 2015 Pocket Version, a more digestible 28 pages. Let me share with you some of the key points that I found most revealing and useful.

The transatlantic economy is bigger than ever. Big, trillions big and compared to other international economic relations, the biggest by far. US foreign direct investment (FDI) in Europe totals >$13.6 (£8.4) trillion. By return of compliment, European FDI in the USA has reached >$9 (£5.8) trillion. Do the math, and we have >$22 (£14.2) trillion of transatlantic FDI. Need more convincing? The transatlantic economy generates >$5.5 (£3.5) trillion in annual total commercial sales. The detail is to be found in this year’s “Transatlantic Economy 2015 Report” which puts it succinctly: “Despite economic turbulence, the US and Europe remain each other’s most important markets. No other commercial artery in the world is as integrated…” The Transatlantic Economy 2015 Report is an Annual Survey of Jobs, Trade and Investment, conducted by authorities on the subject including John Hopkins University, the American Chamber of Commerce to the European Union (AmCham EU) and the Trans-Atlantic Business Council (TABC). The full version comprises 112 information packed pages, reminding us all (which we do need from time to time) of the pre-eminent importance of the economic relationship between the 62 European countries (28 of which are in the European Union) and the 50 United States. The report is very readably structured into: A Tale of Two Economies, The Post-Crisis Transatlantic Economy, The 50 US States and, the last chapter is entitled, European Countries. These are then followed by the somewhat heavy going statistic packed appendices, of which there are more than 40 pages! If you are looking for US/EU stats, look no further. For the time pressed amongst you, I strongly recommend the Transatlantic Economy 2015 Pocket Version, a more digestible 28 pages. Let me share with you some of the key points that I found most revealing and useful.

FDI is often seen as the measure that really articulates economic integration. The fact that “the US and Europe are each other’s primary source and destination for FDI” will be of no surprise to those involved in those black arts of chasing and landing new, as well as extension, FDI. But to non-practitioners bombarded with the economic opportunities of Brazil, Russia, India and China (the BRICs) and other developing countries, that is not the impression we are continually given. The report should read, and we need to know, that the US and Europe have always been, are today and for the foreseeable future will remain, by far, each other’s primary source and destination for foreign direct investment. So the >$22 trillion level of mutual FDI referred to above establishes that fact. The next question is how does this compare in terms of scale with those other FDI opportunities for both the US and Europe. To put this into perspective, US FDI in Europe is >15 times that of US investment in all the BRICs put together. Since 2000, >55% of US FDI went to Europe, including >$544 billion in the Netherlands and > $396 billion in the UK. Another measure of the importance of FDI in Europe is the almost deal breaking negotiations over the proposed investment arbitration provisions to be found in the Transatlantic Trade and Investment Partnership (TTIP). The so called investor-state dispute settlement (ISDS) is proving to be one of the most contentious issues, most especially picked up by Germany where US FDI stands at >$118 billion. The conclusion must be that it is worth spending negotiating time getting ISDS right. Cecilia Malmström, European Commissioner for Trade, was as usual very clear when she recently stated that "The key challenge for the EU's reformed investment policy is the need to ensure that the goal for protecting and encouraging investment does not affect the ability of the EU and its member states to continue to pursue policy objectives. A major part of that challenge is to make sure that any system for dispute settlement is fair and independent."

Trade, including foreign affiliate sales and exports, is the other much researched measure of economic integration. Let’s look at both sides of this wonderful trading relationship that delivers >$5.5 trillion in annual total commercial sales. From a US perspective, US foreign affiliates in Europe are the chosen route for US companies to develop their business and today provide >$2.9 trillion in sales. This huge number represents >47% of all US foreign affiliate sales worldwide. Researching Europe’s foreign affiliate sales in the US we arrive at >$2.3 trillion, establishing the fact that, for Europeans, creating foreign affiliates in the US is also the chosen route to successful business development. European exports of goods and services to the US are a very consistent and hugely important at >$650 billion, surpassing those of the US to Europe by >$150 billion, which are in the order of $500 billion. All of this is enough to keep many millions (>15) of persons directly, and many more indirectly (we are told of a multiplier of 1:3, so think in the region of 45 million), in very useful, highly paid employment on both sides of the Atlantic.

Transatlantic trade in services, both via affiliate and exports, has doubled since 2000 and now represents >$1.2 trillion. This was one of the more surprising finds for me. The US and Europe are the world’s two leading service economies. Sales of services by US affiliates in Europe have reached $665 billion (50% of their world total) with the UK (London, again) alone accounting for >30% of this. By comparison, EU affiliate sales in the US totaled $490 billion. This gives the US a positive trade balance of $175 billion in affiliate services sales. Looking at the export numbers, Europe imports a healthy $250 billion (36%) of US service exports and provides $186 billion (40%) of US service imports. This leaves the US with a comfortable $64 billion service trade surplus. Adding the affiliate and export of services, US > EU is valued at $915 billion, whereas EU > US is valued at $676 billion. The trade in services is today worth a cumulative $1.6 trillion. The report entitles this section “The Sleeping Giant of the Transatlantic Economy”, and I am certain that they are correct. We, at ibt partners, privileged with our transatlantic position serving the online interests of both companies and economic development agencies in the US and Europe, bear witness to this expansion. This takes us nicely to the discussion on the service economy digital sector, where the debate is led by the so called potential digital divide, US world dominance and European regulation. US tech giants hold dominant positions across Europe. These are even more pronounced than those that they hold in their own home US market. Europe is, not unsurprisingly but somewhat belatedly, trying to address this imbalance and the future strategic importance of digital, hence the EU Digital Single Market program. We addressed this highly contentious issue in a previous blog Gunning for GAFA: Google, Apple, Facebook and Amazon.

The transatlantic relationship delivers more so than many pundits care to acknowledge and the future is clearly one of growth. Watch this space and we will be reporting on the transatlantic economy for you. If you would like to download and read a full copy of the Transatlantic Economy 2015 Report click here. Let me know what you think.

If you'd like to learn more about these transatlantic markets, download our exporter guides to Europe and the USA below.