Mexico is arguably Latin America’s most dynamic market for ecommerce for both the B2C and B2B worlds. Retail and ecommerce giants Amazon and Wal-Mart clearly think so and are backing their ambitions with huge investments. Amazon launched in Mexico in June 2015 and according to Juan Carlos Garcia, CEO of Amazon Mexico, the company sees “a big opportunity in the Mexican market. It’s a market which right now is at $12 billion and growth has been in the double digits.”

The Mexico online environment shares characteristics with other fast-emerging digital markets. One of the most obvious is challenging logistics. Mexico is a large country – roughly three times the size of Texas – and rail, road, air transport can be patchy. This is perhaps most problematic for B2C companies, and the reason why Wal-Mart decided to invest a further $1.3 billion in logistics improvements over the coming years. This comes after Wal-Mart’s $4 billion investments between 2012-16.

The Mexico online environment shares characteristics with other fast-emerging digital markets. One of the most obvious is challenging logistics. Mexico is a large country – roughly three times the size of Texas – and rail, road, air transport can be patchy. This is perhaps most problematic for B2C companies, and the reason why Wal-Mart decided to invest a further $1.3 billion in logistics improvements over the coming years. This comes after Wal-Mart’s $4 billion investments between 2012-16.

Besides the logistics challenges, internet penetration and coverage is also patchy. Until recently, Mexico lagged at the bottom of the OECD charts for internet penetration rates with just 42% of the population acheiving decent internet access. Nevertheless, this represents 65 million ‘internauts’ in Mexico out of the total population of 124 million. Of these 65 million, over half live in Mexico’s 3 largest cities; Mexico City, Guadalajara, and Monterrey. This is actually a mixed blessing for online exporters as at least they can concentrate their efforts on a clearly defined urban arena. In addition, with roughly half of Mexico’s population under the age of 30, demographics in Mexico work in favour of continued strong growth in ecommerce. As Amazon’s Garcia notes, “For the next 15 years, we’ll see new people enter the job market, many of whom are tech-savvy and have disposable income.”

The government has given internet access priority over recent years and internet penetration rates are now around 54% and, according to eMarketer, should continue to grow at 6-7 % per annum. This implies 85 million online consumers by 2019. Much of this growth is fuelled by falling costs of mobile phones. Marketing4Ecommerce credit the rise of smartphones – now making up 80% of all mobile phones – as a key driver to Mexico’s double digit growth in ecommerce. Again, typical of a fast-emerging online market, this means that Mexican websites have to be mobile-enabled.

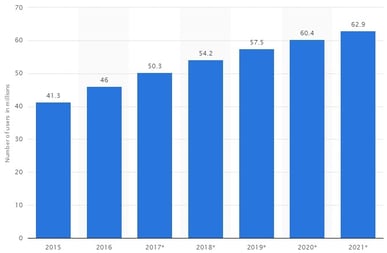

Number of Facebook Users in Mexico 2015 - 2021, source: www.statistia.com

Given Mexico’s online characteristics – a young, urban, mobile-enabled internet population – social media plays a vital role and is a necessary ingredient for any online strategy in Mexico. The good news for exporters to Mexico is that there are few Mexico-only social media platforms. Perhaps because of the strong US influence, the major online players in Mexico are the US giants: Google with over 90% market share and Facebook with a staggering 95% market share according to eMarketer and IAB Mexico.

Given Mexico’s online characteristics – a young, urban, mobile-enabled internet population – social media plays a vital role and is a necessary ingredient for any online strategy in Mexico. The good news for exporters to Mexico is that there are few Mexico-only social media platforms. Perhaps because of the strong US influence, the major online players in Mexico are the US giants: Google with over 90% market share and Facebook with a staggering 95% market share according to eMarketer and IAB Mexico.

We will be looking into and discussing social media in Mexico and how exporters can best use social media optimized for the Mexican market to grow their sales and brands in Mexico. If you would like to learn more about how to sell online in Mexico, check out our webinar