The first ever Anti-Aging trade show was  held in the UK May 2013 and the conclusions we draw reinforced the message from the Paris-based In-Cosmetics Show held in April: the cosmetics industry continues to defy recessions and gloomy consumers. Yesterday’s niche markets have grown into major sectors and show no signs of slowing down. A good example is the cosmetic intervention segment (Botox, IPL treatment, dermal fillers…) which the UK Department of Health estimated was worth £720m in 2005 ($1.1Bn), had increased to £2.3Bn ($3.5Bn) by 2010 and is forecast to reach £3.6Bn ($5.5Bn) by 2015.

held in the UK May 2013 and the conclusions we draw reinforced the message from the Paris-based In-Cosmetics Show held in April: the cosmetics industry continues to defy recessions and gloomy consumers. Yesterday’s niche markets have grown into major sectors and show no signs of slowing down. A good example is the cosmetic intervention segment (Botox, IPL treatment, dermal fillers…) which the UK Department of Health estimated was worth £720m in 2005 ($1.1Bn), had increased to £2.3Bn ($3.5Bn) by 2010 and is forecast to reach £3.6Bn ($5.5Bn) by 2015.

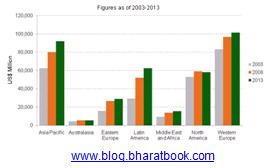

The global cosmetics industry is  estimated to be worth $495Bn in 2012. Growth has clearly come from expanding geographic markets: India is reckoned to be growing at +15% per annum while the Chinese market could overtake Japan within 5 years. But growth is also coming from newly defined sectors: anti-aging, men’s care, suncare, organic cosmetics and the so-called “cosmeceuticals” to name the most obvious. These sectors appeal to a growing audience, including Baby-boomers, Gen X-ers, and increasingly, Gen Y-ers.

estimated to be worth $495Bn in 2012. Growth has clearly come from expanding geographic markets: India is reckoned to be growing at +15% per annum while the Chinese market could overtake Japan within 5 years. But growth is also coming from newly defined sectors: anti-aging, men’s care, suncare, organic cosmetics and the so-called “cosmeceuticals” to name the most obvious. These sectors appeal to a growing audience, including Baby-boomers, Gen X-ers, and increasingly, Gen Y-ers.

Changing consumer profiles has caused company dynamics and business models to shift as well. Gone is the horizontal business model in which the most distinguishing feature was the packaging and the price to match. Ever-better informed consumers are now picking new favourites, opening an attractive window of opportunity for energetic, innovative companies - no matter what their size – to capture market share.

Organic cosmetics are an example where SMEs are proving winners in a growth market. Even in recession-hit Europe, demand in key markets like France and Germany are running at +30% per year. According to industry commentator Oneco (www.oneco.biofach.de) the European natural cosmetic sector reached $3.3Bn last year, accounting for 21% of the global market, ahead of the USA (17% share) but behind Asia Pacific (37% share).

The cosmetics industry is a large driver of the French economy. It is the third largest exporter after the aerospace and beverage industries and France is home to 4 out of the world’s top 15 cosmetics companies – including the industry leader L’Oréal with a 2012 turnover of $26Bn. Importantly, France also has a large number of SME’s (around 80% of the 300 cosmetics companies operating nationwide) occupying industry niches and generating the majority of the 54,000 direct jobs.

Suppliers are the key drivers of the industry as the network of supply chains that supports the industry is dynamic and constantly changing. More and more suppliers are also looking for direct consumers and the hunt for good distributors remains a challenge.

To help you stay ahead of the game, IBT Partners’ whitepaper on Finding Distributors for Export Markets contains best practices and clear solutions for helping exporting companies grow their business internationally through a well managed distributor network.

*Read our Trends in the European Cosmetics Market blog to discover the latest developments in the European cosmetics industry!